What's inflation?

Inflation refers to the rise in the prices of most everyday goods and services, such as food, clothing, housing, or recreation. Essentially, in the UK it’s the purchasing power of each pound. Inflation can affect economies in a positive or negative way, with very high inflation being harmful for the economy, so most economists support a low and steady rate of inflation.

Why is it so important?

The importance of inflation lies in the fact that it affects the value of your money, from the cost of a weekly food shop to the value of savings over a long-term period. With inflation hitting the headlines by reaching 2.5% in June 2021, and many commentators believing it has yet further to rise, it’s something key to pay attention to - particularly this year.

But why now? In order to increase economic activity, the Government has injected money into the UK economy. This started after the 2008 financial crisis and continued more recently through the COVID-19 pandemic. While we have all seen some benefits of this, especially businesses that have struggled during these times, it has pushed up prices over the long-term.

While some people will remember much higher levels of inflation at over 8% back in the 1990s, and it’s unlikely to rise to quite those levels, even at 2.5% inflation has the potential to drastically reduce the spending power of cash and savings over the long-term.

Inflation and its effect on savings

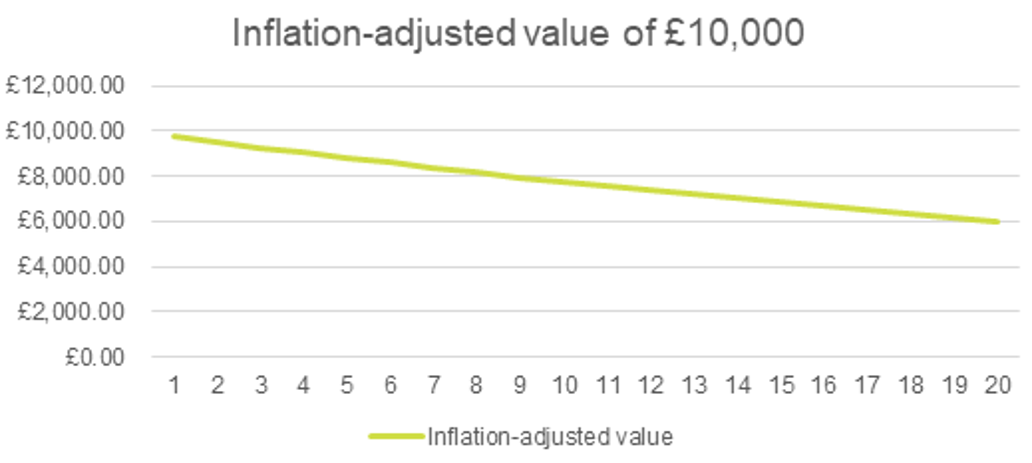

As the graph below shows, while the rate of inflation will fluctuate over time, even at 2.5% it will reduce the spending power of cash by around 40% over a 20-year period – the length of a typical retirement in the UK.

Of course, one way to offset the effect of inflation on cash savings is to have a savings account where the interest rate is high. But with interest rates currently at historic lows, savings rates are significantly lower than the 2.5% current rate of inflation. Triodos savers have the benefit of knowing that while earning interest on their savings their money is also supporting positive environmental, social and cultural change.

What's the impact of inflation over 20 years?

Looking back at the cost of items in 2001 we can clearly see the impact of inflation compared to 2021 prices.

| Items | 2001 | 2021 |

|---|---|---|

A pint of pasteurised milk *₁ | £0.37 | £0.43 |

A white sliced loaf *₁ | £0.51 | £1.06 |

A litre of unleaded petrol *₁ | £0.76 | £1.16 |

An average car *₂ | £12,900 | £19,608 |

An average house *₃ | £93,877 | £265,668 |

*₁ Data from the Office for National Statistics

RPI :Ave price - Milk: Pasteurised, per pint - Office for National Statistics (ons.gov.uk)[RB1]

RPI: Ave price - Bread: white loaf, sliced, 800g - Office for National Statistics (ons.gov.uk)

RPI: Ave price - Ultra low sulphur/Unleaded petrol, per litre - Office for National Statistics (ons.gov.uk)

*₂ Data from Back in my day

*₃ Data from the UK House Price Index

So, what are the alternatives if you still want your money to have impact?

Those who want to continue to have impact, but also to increase the potential for returns, could explore investing in the Triodos Impact Investment Funds. Investing is a powerful lever for change, so arguably it is a tool to increase the impact of your money, as well as countering the effect of inflation.

Investing with Triodos Bank for the first time requires a minimum initial deposit of £1,000, and investments can subsequently be topped up from £500. These investments can be held in a Triodos Stocks and Shares ISA tax-efficiently up to £20,000 (ISA rules apply) or in an Investment Account. Investing comes with risks, as investments can fall in value as well as rise, so you could get back less than you invest.

A risky business?

Some potential investors are put off by the risks, which is understandable as no one likes the idea of losing money. But the great thing about investing is that it’s a personal choice – leaving each person to take as much or as little risk as they’re comfortable with.Learning more about the risks involved by seeking more information and/or independent financial advice helps to gauge what could be right for each individual and their circumstance.

There are a number of specific considerations that relate to risks in our funds:

- Triodos Investment Management (the investments experts within Triodos who build our impact investments) only offer actively managed funds. This means that they are consistently monitoring the investments to help to mitigate, navigate and manage a whole range of risks along with any anticipated peaks and troughs in the marketplace.

- The premise of investing in funds is that it’s unlikely that lots of different companies (in our funds around 40-50) would all under perform stock market expectations at the same time, whereas investing in one company can leave an investor subject to more risk.

- Impact investing in funds such as ours always comes with a range of risks, including currency risk, market risk and climate risks (both physical and transition). You can find out more about these different types of risk at the end of the article.

- The selection process for our funds helps to mitigate risk. Companies are rigorously selected and must adhere to some of the strictest minimum standards in the industry. Our approach also filters in the companies that are positively contributing towards greater sustainability and are aligned to the Sustainable Development Goals.

- The funds are designed to be long term investments, for five years or more. The companies within them have a long-term view of sustainability, since the aim of the funds is to generate returns and impact in the long term. Note, however, that returns are never guaranteed.

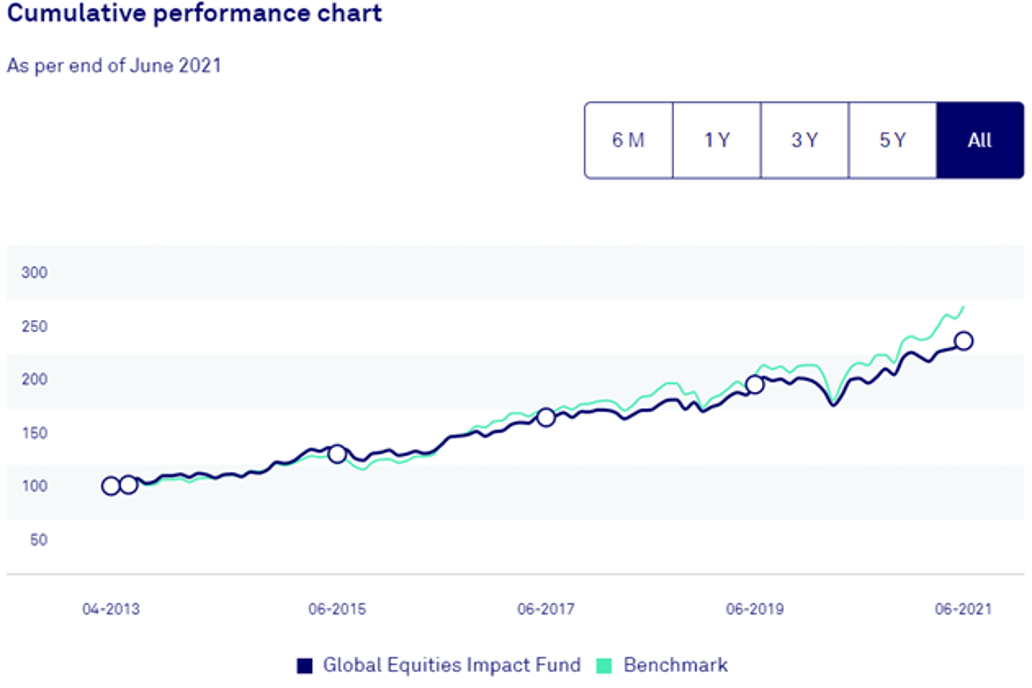

Below is an example of the performance of the Triodos Global Equities Impact Fund. £10,000 invested at launch in 2013 would be worth over £20,000 today, although it should be remembered that past performance isn’t a guide to future returns.

Learn more about our range of funds

Overall, good financial planning lies in a balanced and diversified approach (e.g. separating money into different financial products like savings and investments), which is one adopted by many Triodos investors.

Before making an investment, one of the hardest questions is how much should you invest? Everyone’s situation is different, so there’s no one size fits all answer, but below are some general financial planning principles to help get you started.However, the information in this article is not financial advice, and if you are unsure about whether any investment product meets your needs then you should seek the advice of an independent financial adviser.

Pre-investment tick list

- Emergency savings pot - this is an amount for a rainy day or any emergency needs. Typically, this could be around three to six months’ worth of income, and those who are retired may want more than this.

- Fixed-term savings - for anyone who is happy to commit some money for a longer period in order to get a better return, they could consider fixed term savings for any surplus cash.

- Explore investing and pick investments suitable for you - with a cash buffer this is a suitable opportunity to consider investing. Investors in the Triodos Impact Investment Funds don’t need to be existing bank customers and the three funds have different risk levels, so it’s worth exploring what could be suitable. In addition, there is an opportunity to invest in one or more funds and investments can be cashed in if money was needed.

Discover our Impact Funds

Our award-winning Triodos Impact Investment Funds invest in a range of stock market listed companies and bonds that have a positive impact on society and the environment.

Remember that investments are designed for the long-term, because of the fact that their value can go down as well as up.

Overview of the main risks

Market risk

The fund is subject to market risk, which is the risk caused by changes in the price of the investments. The fund mitigates this risk by means of careful selection and diversification of investments.

Currency risk

Currency risk arises because investments by the fund may be denominated either in euros or in foreign currencies. In principle, the fund does not hedge the currency risk of these investments.

Physical risk

The risk of losses (realised and unrealised) as a result of direct physical impact of climate change, including impacts on insurance liabilities and the value of financial assets that arise from climate and weather related events such as rising sea levels, forest fires, heat waves, and floods and storms that damage property or disrupt trade or production. Physical risk may affect companies both directly through damage or loss of assets and indirectly through its effects on supply chains.

Transition risk

The financial risks that could result from the process of adjustment towards a lower carbon economy. Sudden or disorderly changes in policy, technology and physical risks could prompt a reassessment of the value of a large range of assets (i.e. repricing risk, stranded assets) as costs and opportunities become apparent.

Litigation risk

The impact that could arise in the future if parties that have suffered loss or damage from the effects of climate change seek compensation from those they hold responsible. These types of claims are likely to impact most severely on carbon extractors and emitters, and their insurers.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.